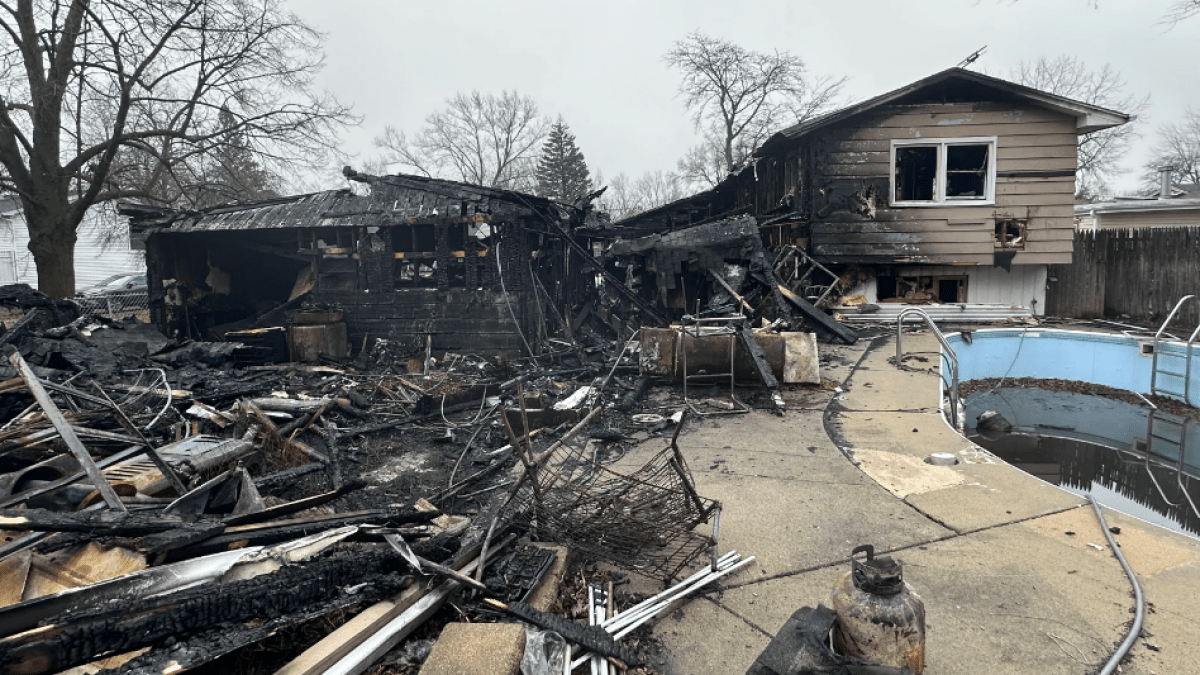

A devastating house fire that completely destroyed a Grayslake family’s home spotlighted the hidden costs of rebuilding and the checkered landscape of solar panel financing. The unfortunate event unfolded on a Christmas day when an oven malfunctioned, causing a devastating fire while only his daughter was at home making cookies.

Cassius Lyandisha, the homeowner, arrived at the scene, only to discover the ashes of the residence where he had lived happily with his spouse and two children for two years. Everything they owned – bricks, lives, dreams – had turned into embers. The fire not only consumed the house but also the family’s two beloved pets. Lyandisha’s daughter was, however, saved by a neighboring samaritan.

The house that used to stand on the now-barren lot was not an ordinary home. Lyandisha had added numerous extensions and renovations to the house, including a pool, a boat, a sun room, and a second kitchen, which were now the charred leftovers of the fire. After the incident, Lyandisha was well aware of the mammoth financial burden facing him to restore the dwelling to its previous state.

While examining the leftover ruins and calculating the potential rebuilding costs, Lyandisha was slapped with another financial shock. Amongst the costly home additions that the fire had claimed, was an $81,000 solar panel system, which was installed merely weeks before the unfortunate incident. The panels had not passed the most recent county inspection and were, therefore, not operational or insured at the time of the fire. Yet, despite its non-functionality and being unsalvageable post-fire, the family’s struggles were magnified when they received a bill for the exact full amount just days after the fire.

The company that was responsible for the installation of the solar panels, Titan, was already out of business and hence unable to offer any help. Increasingly desperate, Lyandisha tried communicating with Goodleap, the finance accomplice of the solar panels, but hit a dead-end. Worse, his credit score took a blow when the payments for the non-existent solar panels were not made.

With no other available recourse, Lyandisha approached an authority for help, who then strived to secure a favourable solution. After discussing the circumstances, Goodleap revealed that they would cancel the contract and waive the loan’s remaining balance. The company also committed to ensuring the upliftment of Lyandisha’s credit score, thereby providing a much-needed lifeline.

While the news, undoubtedly, was a huge relief for the afflicted family, the road to recovery is still a long one. Lyandisha had to bite the reality that rebuilding the house was not feasible due to his outdated homeowners’ insurance, which had not been updated when he had made renovations in the home. The substantial deficit between the insurance amount procured post-fire and the rebuilding costs required forced the family to buy a new property, which would also need massive refurbishment.

Interestingly, this unfortunate saga serves as an inadvertent lesson to all homeowners. As Chris Schafer from Insurify points out, insurance coverage needs to be regularly updated, especially when expensive home renovations are made. A periodic review of the home insurance policy is also crucial to ensure it aligns with the current needs, potentially saving homeowners from finding themselves overly insured or, even worse, under-insured.